Information contained in this news release is current as of the date of the press announcement, but may be subject to change without prior notice.

Hitachi and VietCredit Start a Demonstration Experiment to Provide New Financial Services Using AI (PDF Type, 386kByte)

Công ty Tài chính Cổ phần Tín Việt và Tập đoàn Hitachi chính thức hợp tác triển khai chương trình thử nghiệm Mô hình đăng ký vay trực tuyến kết nối trực tiếp với tư vấn viên (PDF Type, 381kByte)

February 10, 2020

Hitachi and VietCredit Start a Demonstration Experiment to Provide New Financial Services Using AI

Verifying effectiveness to introduce an automatic loan contract service on tablets and a loan screening service using AI

The launch ceremony

Tokyo, February 10, 2020 – Hitachi, Ltd. (TSE:6501, “Hitachi”), Hitachi Asia (Vietnam) Co, Ltd. (“Hitachi Asia (Vietnam)”), a local subsidiary of Hitachi in Vietnam, and VietCredit Finance Company (“VietCredit”), a consumer financial institute in Vietnam, today announced that the three companies have reached an agreement on the start of a demonstration experiment (“the Demonstration”) to provide new financial services using digital technology such as AI.

Specifically, the three companies will introduce an automatic contract system on tablet terminals at some VietCredit offices for verification in a service that enables convenient submission acceptance and contracts for personal loans, as well as to perform scoring with “Hitachi AI Technology/Prediction of Rare Case (AT/PRC)”, Hitachi’s Artificial Intelligence that can predict rare events, to verify its usefulness in loan screening.

Through the Demonstration, the companies will identify issues and verify the effectiveness to provide new financial services that improve customer convenience, such as shortening turnaround time for loans from acceptance of submissions to the conclusion of contracts. In the future, they aim to create a service that combines the automatic contract service and the AI loan screening service to digitize a series of procedures from acceptance of submissions to identification, screening and contracts.

The service for the conclusion of a loan contract automatically on a tablet terminal is a first attempt in Vietnam. The companies will install tablet terminals in VietCredit offices and gradually expand installation areas to office buildings and industrial parks to create an environment in which more people can access financial services.

Recently in Vietnam, alongside with the rapid economic development and expansion of the middle-income group, personal consumption-related demand is increasing. The size of the personal loan market is expanding remarkably.

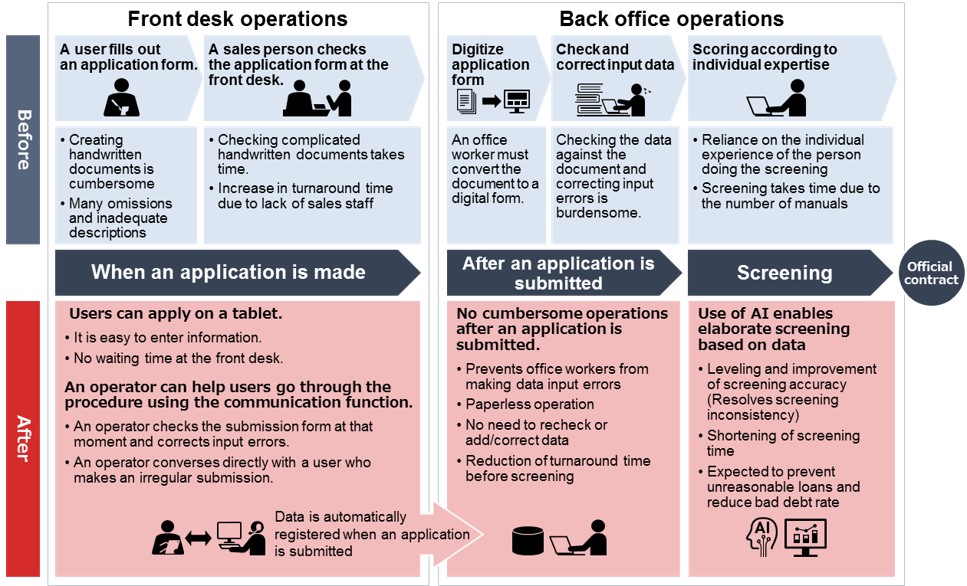

While the market is expanding, because office work at reception and back offices is usually done with paper at financial institutes in Vietnam, there are many issues in terms of work efficiency, such as rework due to incomplete documents and an increase in turnaround time. Also, the increase in transaction volume of personal loans demands more accurate credit screening to protect consumers and prevent unreasonable loans in advance.

Because of this situation, Hitachi, Hitachi Asia (Vietnam) and VietCredit have agreed to cooperate for the advancement of financial services in Vietnam. Based on the agreement, they will start by studying automatic contract services using AI. The companies will create a reliable, secure service, taking advantage of Hitachi’s achievements and knowledge on automatic contract systems for personal loans, which was cultivated in Japan.

The creation of the automatic contract service will reduce the burden on reception operations, which are conventionally paper based, such as digitizing handwritten documents and checking inadequate descriptions, as well as making office work more efficient and of higher quality. Users can enter and submit information easily with guidance from an operator using the communication function on a tablet terminal, being able to avoid cumbersome handwritten document creation, which improves convenience and shortens turnaround time. In contrast to dedicated automatic contract machines, by taking advantage of the property of portable tablet terminals, the service is available in the office and outside, allowing contract personnel to use it while visiting, contributing to further channel expansion and opportunity creation.

When screening loans at back offices, the service performs scoring with Hitachi’s original AI “AT/PRC,” which has been used for mortgage screening by financial institutes in Japan(1). It enables elaborate screening based on data and the reduction of reliance on individual experience to enhance efficiency such as the further improvement of accuracy and the reduction of turnaround time.

VietCredit will continue to integrate advanced technology to expand convenient and innovative financial services in Vietnam to respond to customer needs. Based the results of the Demonstration, Hitachi will facilitate the development of new solutions to evolve loan systems as well as continuously enhance services by using cutting-edge IT, such as PBI(2) biometric authentication technology and voice recognition technology. In addition, Hitachi will expand these initiatives in Vietnam to Japan and Southeast Asia, where demand is expected, to contribute to the expansion of financial services in Asian markets and the improvement of convenience.

(1) Hitachi News release on January 29, 2019 SBI Sumishin Net Bank and Hitachi Sign a Memorandum of Understanding towards Establishing a Joint Venture to Provide AI Investigation Services https://www.hitachi.com/New/cnews/month/2019/01/190129.html

(2) PBI: Public Biometrics Infrastructure

Overview of the Demonstration

About Hitachi AI Technology/Prediction of Rare Case (AT/PRC)

AT/PRC is one of Lumada Solutions as well as an Explainable AI that precisely predicts low-frequency events and has a capability to present their reasons. It features learning based on signal and noise to train for immunity against biased data and extreme data, and impact calculation technology to quantifiably present the reasons for a prediction, in addition to learning normal data. Because it is suitable for operations that require the prediction of rare events and an explanation of the prediction reasons, the AI is expected to be applied for a range of risk management operations that companies work on, such as the unauthorized transaction screening of stocks, the assessment of new customers and suppliers, and credit surveys.

About VietCredit

VietCredit is an emerging financial institute, which in June 2018 obtained a business license and was renamed from Cement Joint Stock Finance Company, which has operated in the Vietnam financial industry for over a decade. It was originally a part of Vietnam Cement Industry Corporation, a Vietnam national cement company. Based on work experience at a consumer financial institute in Japan, Ho Minh Tam, founder and president, actively adopts operational know-how and advanced technology in Japan to provide innovative financial services in Vietnam.

Currently, VietCredit has expanded to 80 offices in 38 provinces of Vietnam, with more than 1,300 employees centered on sales representatives. It rapidly bolsters a network of offices and its sales force, resulting in fast growth in Vietnam.

About Hitachi Ltd.

Hitachi, Ltd. (TSE: 6501), headquartered in Tokyo, Japan, is focusing on Social Innovation Business combining its operational technology, information technology and products. The company’s consolidated revenues for fiscal 2018 (ended March 31, 2019) totaled 9,480.6 billion yen ($85.4 billion), and the company has approximately 296,000 employees worldwide. Hitachi delivers digital solutions utilizing Lumada in five sectors including Mobility, Smart Life, Industry, Energy and IT, to increase our customer’s social, environmental and economic value. For more information on Hitachi, please visit the company’s website at https://www.hitachi.com.